안녕하세요. mbn골드 이가람 매니저 입니다.

결론, 미 증시 약세.

국내 최근 강했던 종목군. 대안주에 지속 관심 필요.

떠오르는 그 종목을 하면 됩니다.

자세한 내용은 화, 목요일 21시 50분 공개방송을 참고하세요.

---------------------------------------------------------------

[미 증시 요약]

주요 원인:

미 국채 금리 급등 → ‘Sell USA’ 심리 자극

국채 입찰 부진, 무디스 신용등급 강등 등 → 금리/환율 불안

소비 둔화 우려 → 일부 소매주 실적 부진 반영

미국 국채 금리 상승:

20년물 국채 입찰 부진 → 응찰률 2.46배(평균 2.58배)

30년물 금리 2023년 이후 최고치 기록

일본 금리도 상승 중: BOJ 국채 매입 축소 우려, 정치·재정 불안 반영

CTA·헤지펀드의 장기물 매도세 → 수급 악화

==> 원래 20년물은 시장에 큰 영향을 주지 않았었고, 규모 또한 크지 않음.

==> 시장은 키워드가 필요했던 상황에 응찰률이 낮았다는 키워드에 기다렸다는 듯이 매물이 나왔음.

외환시장 영향

달러 약세 / 원화 강세:

달러/원 1,371.80원까지 하락

무디스 등급 강등, 미국 재정 불안

G7 회의 전후 환율 협조 기대감 반영

[ 미국 증시]

- DOW: 41,860.44p (-816.80p, -1.91%)

- S&P500: 5,844.61p (-95.85p, -1.61%)

- NASDAQ: 18,872.64p (-270.07p, -1.41%)

- 러셀2000: 2,046.56p (-59.02p, -2.80%)

- 필라델피아 반도체 4,802.71(-1.80%)

- Nasdaq Biotechnoogy 4,093.80(-2.01%)

- VIX 20.77(+14.81%)

[외환시장]

- 달러인덱스: 99.605 (-0.513, -0.51%)

- 유로/달러: 1.1329 (-0.0002, -0.02%)

- 달러/엔: 143.58 (-0.10, +0.07%)

[미국 국채시장]

- 2년물: 4.0194% (+4.9bp)

- 10년물: 4.5985% (+11.2bp)

- 30년물: 5.0923% (+12.3bp)

- 10Y-2Y: 57.91bp (6.26bp 확대)

[상품시장]

- WTI: 61.57 (-0.46, -0.74%)

- 브렌트유: 64.91 (-0.80, -1.22%)

- 금: 3,341.90 (+29.30, +0.88%)

- 은: 33.65 (+0.47, +1.42%)

- 구리: 467.20 (+1.80, +0.39%)

[특징주]

1. Target -5.23%

- 1분기 매출이 예상을 하회한 데다, 관세·DEI(다양성·형평성·포용성) 정책 폐기로 인한 소비자 반발 등 여파로 회사가 연간 매출 전망을 하향조정하며 주가 급락

2. Palo Alto Networks -6.80%

- 1분기 매출 및 이익은 양호한 수준을 보였으나 매출총이익이 시장 예상치를 하회하면서 주가 급락

3. Lowe's Companies -1.78%

- 올해 1분기 이익은 시장 예상치를 상회했지만, 매출이 다소 실망스러우며 주가 하락

4. 항공주 급락

- 미국 연방항공청이 네트워크에 항공편 감축을 지시하자 항공주들의 주가 급락

- United Airlines -3.93%

- Delta Air Lines -3.43%

- American Airlines Group -3.52%

5. Canada Goose +19.62%

- 기대 이상의 실적에 주가 급등

▶ Market Mover

- Wolfspeed -59.15%

- Target -5.23%

- NVIDIA -1.92%

- Lottery.com +134.58%

- Canada Goose +19.62%

- XPeng +13.00%

▶ Market Gainers

- Dycom Industries +15.76%

- XPeng +13.00%

- Arcellx+8.26%

- Dundee Precious Metals +7.74%

- GDS Holdings +7.51%

- Hesai Group +7.46%

▶ Market Losers

- Wix.com -16.18%

- V.F. -15.80%

- Fair Isaac -15.74%

- Garrett Motion -13.03%

- Modine Manufacturing -11.66%

- The AES -9.88%

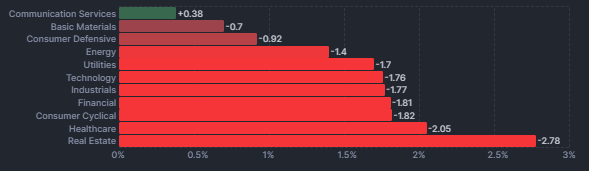

주요 업종 및 종목 흐름

[빅테크 7]

알파벳(+2.87%): AI 기반 검색에 대한 기대감

애플(-2.31%): OpenAI의 조니 아이브 영입 소식

아마존(-1.45%), 메타(-0.25%), MS(-1.22%)

엔비디아(-1.92%), 테슬라(-2.68%),

[반도체]

장 초반 강세 → 장 후반 하락 전환 (금리 급등 영향)

엔비디아(-1.92%), AMD(-1.28%), 마이크론(-2.30%), 브로드컴(-0.84%) 등.

엔비디아(-1.92%),

젠슨 황 "결국, 미국의 반도체 수출 통제는 실패했다"

“제재가 중국의 정신, 열망, 정부 지원을 가속시켰음.

-4년 전 중국 시장 점유율 95%에서 지금은 50% 지난해 중국 매출 170억 달러, 10년래 최저 기록

-미 상무부, H20 저사양 GPU에도 수출 라이선스 요구 엔비디아 이후 55억 달러 재고 손실 반영

[소프트웨어]

팔란티어(-3.99%), 오라클(-1.95%), 세일즈포스(-2.01%) 등.

[전력망]

GE버노바 +0.66%, 콘스텔레이션에너지-1.81% 등

뉴스케일파워 +1.66%, 오클로 -2.02% 등

[전기차 / 2차전지]

테슬라(-2.68%), 리비안(-3.43%), 루시드(-6.42%), ㅣ퀀텀스케이프(-2.01%), 앨버말(-4.86%)

[완성차]

번스타인이 하반기와 내년에 자동차 산업의 침체에 대해 경고

GM(-1.67%), 포드(-2.24%) 등.

[소매유통]

타겟(-5.21%), VF 코퍼(-15.80%), 메이시스(-3.89%), TJX(-2.89%) 등

나이키(-4.12%)

관세 반영해 신발 가격 $2~10씩 인상 전망(6월)

[양자컴퓨터]

씰스큐(+6.15%), 아킷퀀텀(+5.12%)

아이온큐(-5.01%), 디웨이브(-7.25%) 등 엇갈림

[우주항공]

로켓랩 -3.19%, 인튜이티브 머신스 -5.71% 등

[비트코인 관련주]

장중 비트코인 신고가에도 종목 대부분 하락

코인베이스(-0.91%), 스트레티지(-3.41%), 라이엇 플랫폼(-1.01%) 등

[중국기업]

알리바바(-1.25%)는 최근 미국 당국이 애플과의 전략적 파트너십에 대해 조사를 가하고 있다는 소식.

바이두(-4.32%), 핀둬둬(-1.01%), 진둥 닷컴(-0.88%)

*중국 전기차

샤오핑(+13.00%), 리 오토(+3.08%), 니오(-0.51%) 등

[제약바이오]

일라이릴리 -2.95%, 존슨앤존슨 -0.31%, 암젠 -1.33%, 화이자 -2.04%, 길리어드사이언스 -1.27%, 머크-1.27% 등.

템퍼스AI -6.87%, 인튜이티브 서지컬 -1.81%

[방산]

록히드마틴 -1.16%, Northrop Grunmman -0.57%, RTX -1.63%

유럽 : 라인메탈 +0.84%, Saab +1.80%, 레오나르도 +1.41%, 헨솔트 +2.07% 등.

[신재생]

퍼스트솔라 -2.30%, 엔페이즈에너지 -3.57%, 솔라엣지 -3.92% 등

베스타스 -3.14%, 오스테드 -5.65%, 풍력ETF -2.02% 등.

[종합 정리]

> ‘금리 상승’ → ‘달러 자산 불안’ → ‘Sell USA’ 심리 확산

미 재정건전성, 국채 수급, 고평가 부담 등이 복합적으로 작용하며 주식·환율·채권시장 전반에 변동성 확대

특히, 금리에 민감한 고밸류 종목과 장기채권 중심으로 투자심리 위축

- MSCI 한국지수 ETF: $59.10 (+0.70, +1.20%)

- MSCI 이머징지수 ETF: $46.19 (-0.12, -0.26%)

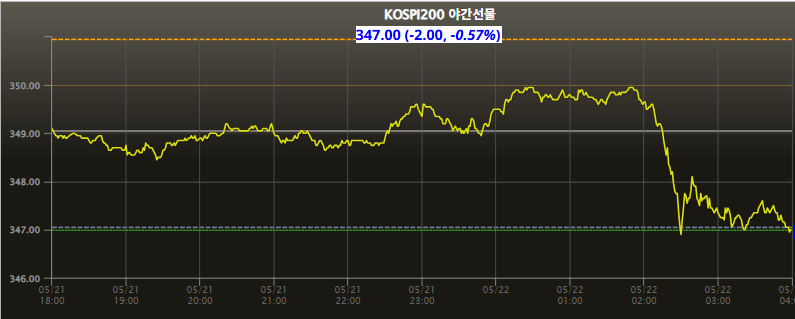

- Eurex kospi 200: 347.00p (-2.00p, -0.57%)

- NDF 환율(1개월물): 1,371.92원 / 전일 대비 1원 하락 출발 예상

- 필라델피아 반도체: 4,802.71 (-88.07, -1.80%)

|